The Case for Change

Underperforming Industry Peers

Over the past five years, Air Products has significantly underperformed its industry peers, the S&P 500, and its own potential due to its flawed strategy, inappropriately high-risk capital allocation program, and poor execution. The root cause of these issues is a range of oversight and governance failures at the Board level, including its failure to replace CEO & Chairman Seifollah “Seifi” Ghasemi.

The five-year relative total shareholder return (“TSR”)1, ending October 4th, 2024, the day before announcing our efforts to press for change catalyzed a nearly 10% jump in the Company’s shares, tells a powerful story – Air Products has delivered roughly one-half of the TSR of competitor Air Liquide and the S&P 500, and less than one-third of the TSR of best-in-class competitor Linde Plc.

Paul Hilal and Brian Welch of Mantle Ridge on the urgent case for change at the Board and management level of Air Products.

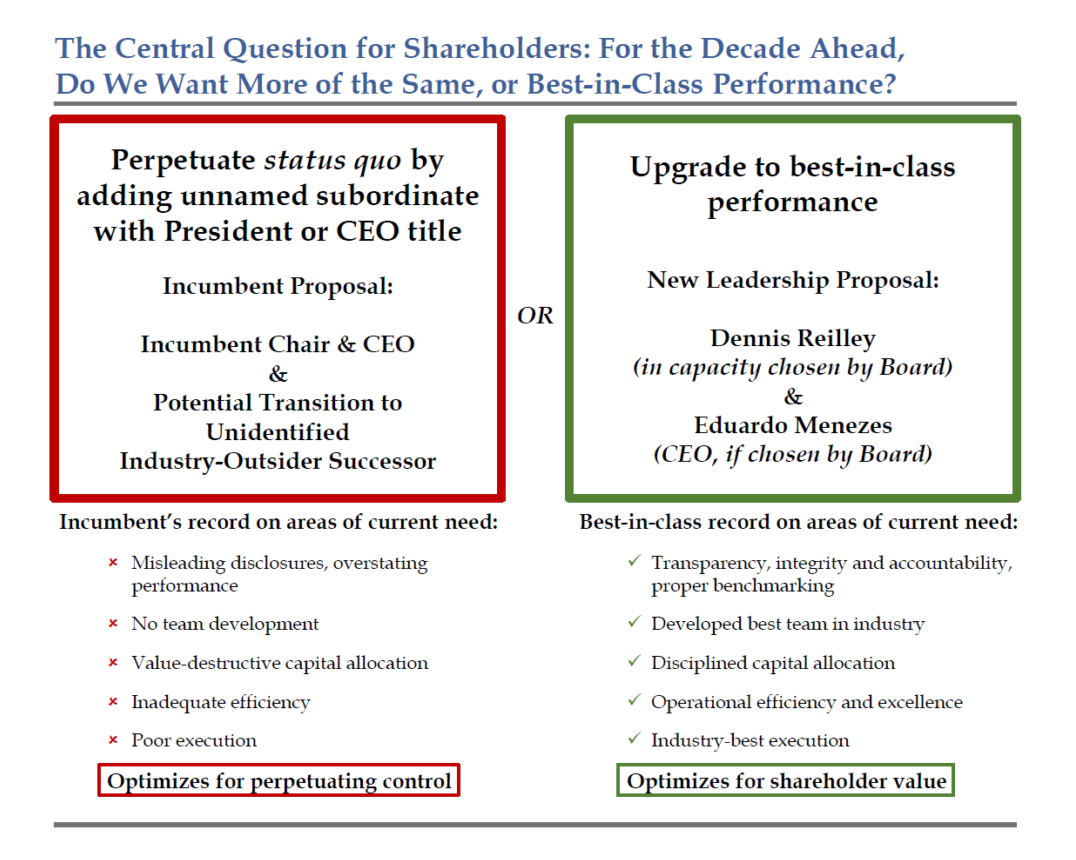

Deficiencies in Mr. Ghasemi’s judgment, coupled with his failure to maintain execution discipline, have elevated Air Products’ risk profile to unacceptable levels, generated inadequate returns, and destroyed substantial shareholder value.

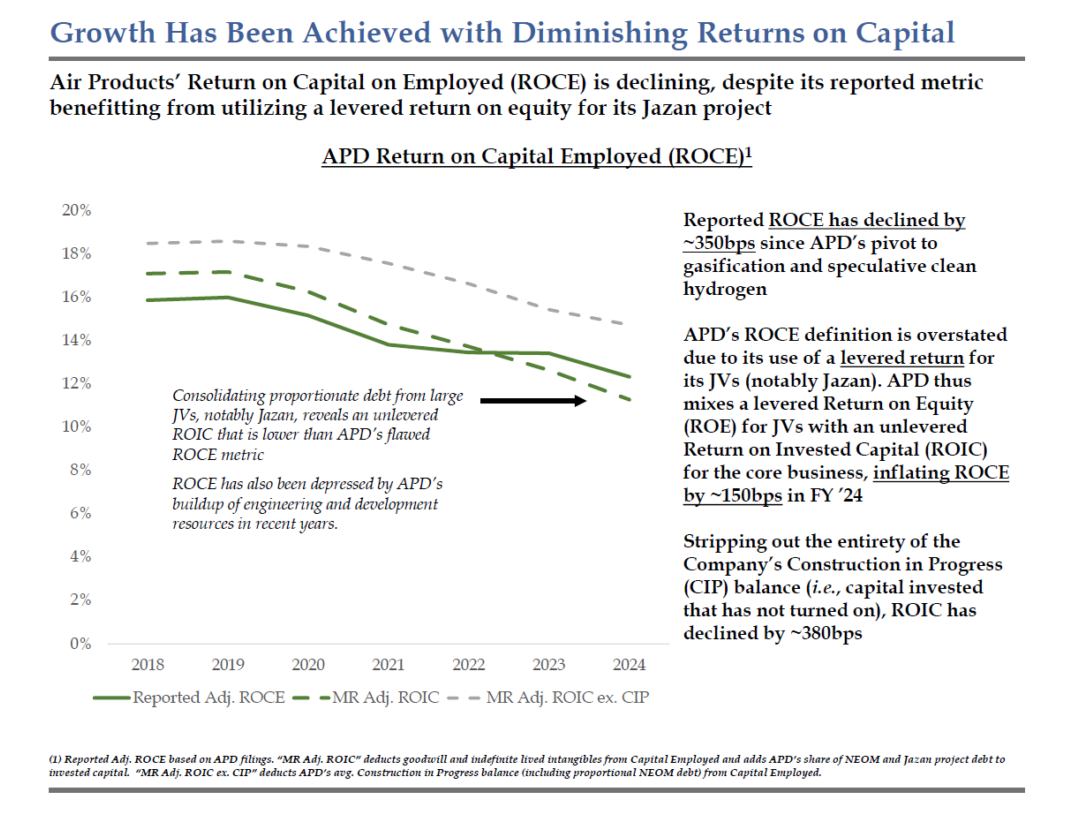

Mr. Ghasemi and the current Board have misallocated a significant amount of shareholder capital to inferior, non-core projects with high risk profiles that offer inadequate or speculative returns. These include poorly executed “mega projects” which have been plagued by wide-ranging problems and ballooning budgets – adding unnecessary risk to, and diminishing the value of, Air Products’ otherwise low-risk core business.

As a result, Air Products’ margins have been meaningfully depressed by excessive costs directly tied to the expanded scope of its multiple non-core projects. Before Mantle Ridge surfaced, the Company traded at an historically deep valuation multiple discount to its peers — this revealed how poorly the market views the Company’s leadership divergent strategy, poor capital allocation, project execution, and depleted management ranks.

Despite these missteps, the Board has allowed Mr. Ghasemi – ten years into his tenure and now eighty years old – to frustrate the Board’s efforts to replace him, and in fact to further increase his leverage over the Board. His purpose is to perpetuate his dominion through enhancing leverage and control, rather than earn an extension of his tenure by delivering strong performance. His own words tell the story: “I am not going anywhere”2, “I am leaving this Company only one way – feet first”3, “I will be Chairman of this Company so long as I am vertical”4, “I always tell these people they get rid of me when I go horizontal”5, and “I will be the first 100-year-old CEO”6.

The Board’s rejecting out of hand Mr. Eduardo Menezes as a CEO candidate reveals that its priority is not maximizing shareholder value, but perpetuating control and protecting prior decisions. Mr. Menezes would bring fresh-eyed scrutiny and run the Company to maximize its value without regard to legacy decision making.

Shareholders have the extraordinary opportunity to restructure the Company’s underperforming Board into a far stronger one, and in doing so, give Air Products a chance to reset to a far healthier course of consistent, low-risk, high-return growth, just like its competitors.

Mr. Ghasemi’s Priority is Extending his Personal Control of the Company, and Blocking Efforts to Remove Him

1 Source: Bloomberg, as of 10/4/2024, the trading day before Mantle Ridge’s surfacing. Returns in USD and assumes dividends are reinvested.

2 Source: May 27, 2020, Bernstein conference.

3Source: December 18, 2023 transcribed expert network call with former APD SVP: “But as he’s made it very clear that he’s not going to retire from Air Products. He’s going to leave in a box those are his words not mine.”

4Source: June 9, 2020 Deutsche Bank conference.

5Source; May 6, 2016 EvoniK M&A teleconference.

6Source: June 27, 2022 transcribed expert network call with former APD Director of Business Development: “But at the end of the day I mean, he told us that he wants to work until he is, like, 100 years old, so.”

Under the stewardship of a strong, healthy, reconstituted Board, Air Products stands to create enormous shareholder value through several straightforward initiatives:

- Restore capital allocation discipline

- Build depleted ranks into a robust management team

- Expand margins materially and narrow margin deficit to best-in-class peer

- Bring core business cost structure in line with peers

- Eliminate more than $1.00/share of excess non-core project costs

- Improve the Company’s industry-worst return on capital

- Accelerate growth

- As the smallest player, Air Products can grow faster without straying from core

- Optimize existing and pipeline projects

- Objectively focus on maximizing shareholder value

- Derisk challenged projects

- Restore transparency and integrity to Company disclosures

- Appropriately align compensation

Successfully executing on these initiatives should close the valuation multiple discount at which Air Products trades and generate significant value for Air Products’ shareholders.

Reset the Board’s Culture & Standards

The Solution to These Self-Inflicted Problems is Clear

Air Products’ Board of Directors must be reconstituted to replace its most problematic directors with new, highly qualified independent directors who bring relevant experience – including from the best-in-class player in the industrial gas industry – to reset the Board’s culture and elevate it to the highest standards of accountability, oversight, and governance.

- Mantle Ridge has nominated four highly qualified independent directors to Air Products’ Board – Andrew Evans, Paul Hilal, Tracy McKibben and Dennis Reilley. These nominees can work closely with the rest of the Board to help restore the Company’s performance and value.

- We have also identified a world-class industrial gas industry executive with an unimpeachable track record of value creation – Eduardo Menezes – who we and others believe is the ideal leader to helm the Company as CEO. A reconstituted Board should promptly launch a CEO succession process that includes Mr. Menezes as a candidate. If chosen as CEO, Mr. Menezes could start immediately.

- Yet rather than engage with us to explore and develop possibilities for a Board restructuring, Mr. Ghasemi and the Board have chosen to continually mislead shareholders about Mantle Ridge, our intentions, our performance, and our nominees, and to advance a Board “refreshment” proposal that simply exacerbates the problem. As is made clear in our proxy filings and published correspondence with the Company, Mantle Ridge has never sought control of Air Products.

- On the contrary, the executives we have nominated are prepared to work collaboratively with the reconstituted Board to elevate the Company’s performance and to create durable long-term value for all shareholders. To learn more about Mantle Ridge’s approach, click here.

- To restore the Board’s integrity, elevate its standards of governance, and best address the Company’s troubled projects, and to install effective leadership at Air Products that can best create long-term shareholder value, we urge shareholders to vote the BLUE proxy card “FOR” Mantle Ridge’s four highly qualified director nominees and “WITHHOLD” on the Company Nominees: Charles Cogut, Lisa A. Davis, Seifi Ghasemi and Edward L. Monser.

The “Dream Team”

Change Agents: The “Dream Team” of Industrial Gas Industry Legends Eduardo Menezes & Dennis Reilley

Eduardo Menezes

Eduardo Menezes is a distinguished leader in the industrial gases sector with more than three decades of experience at the best run industrial gas companies in the world — the industrial gas unit of Union Carbide, which was later spun out as Praxair, which ultimately combined with and took the name of Linde. During his last 11 years at Praxair and Linde, he was a direct report to the CEO and Chairman.

Over his career, Mr. Menezes had at some point leadership responsibility for each region in the world, giving him a global perspective. In each case, he led improvement in the unit’s performance. Over the decades, Mr. Menezes has surmounted the full range of operational and organizational challenges to drive performance improvements all over the globe. His experience and approach enable him to quickly drive durable improvement while minimizing disruption and setbacks. He most recently served as the EVP of EMEA for Linde Plc, helping boost the performance of that 18,000-person unit by 550 basis points in just three years.

Dennis Reilley

Dennis Reilley is a renowned industrial gas industry executive who previously served as Chairman, President and Chief Executive Officer of Praxair, Inc. (now Linde plc). Mr. Reilley is widely considered the architect of Praxair’s best-in-class model, which is distinguished by its culture of empowerment and accountability, relentless cost discipline, rigorous and strict capital allocation program, and focus on risk-adjusted returns. This model is the “gold standard” of the industry and drives consistently strong shareholder returns. During Mr. Reilley’s tenure at Praxair, he achieved best-in-class total shareholder returns, revenue growth, EBIT growth, EBIT margins, and returns on invested capital. Mr. Reilley also established a strong succession plan, positioning Praxair for continued success.

Analysts agree that installing the “Dream Team” at Air Products represents the best path forward for the company and would deliver meaningful long-term value to shareholders:

Our Nominees

Mantle Ridge’s four highly qualified director nominees will provide much needed independent voices in the boardroom and bring extensive expertise and relevant experience, including from the industrial gas industry to the Company’s Board. They will provide valuable insight on how to address the most pressing challenges the Company currently faces across corporate and operational strategy, capital allocation, and human capital. We believe these nominees can help instill accountability and governance on the Board while driving improved performance – and ultimately enhance value for all Shareholders.

Learn more about the Nominees:

The Mantle Ridge Nominees prioritize good governance, and maximizing value for shareholders.