Mantle Ridge Letter to Air Products Shareholders

Dear Fellow Air Products Shareholders,

Mantle Ridge is one of the Company’s largest shareholders, holding approximately $1.3 billion worth of common shares. Our mission is to help boards most effectively create durable value for shareholders and other stakeholders. We are very long-term partners. We anticipate maintaining a stake, and if elected to the Board, continuing our service to Air Products, long into the future. This aligns us with other long-term stakeholders of the Company, including employees, customers, partners, and shareholders.

Shareholders have the extraordinary opportunity to restructure the Company’s underperforming Board into a far stronger one, and in doing so, give Air Products a chance to reset to a far healthier course of consistent, low-risk, high-return growth, just like its competitors.

Under the stewardship of a strong, healthy, reconstituted Board, Air Products stands to create enormous shareholder value through several straightforward initiatives:

- Restore capital allocation discipline

- Build depleted ranks into a robust management team

- Expand margins materially and narrow margin deficit to best-in-class peer

- Bring core business cost structure in line with peers

- Eliminate more than $1.00/share of excess non-core project costs

- Improve the Company’s industry-worst return on capital

- Accelerate growth

- As the smallest player, Air Products can grow faster without straying from core

- Optimize existing and pipeline projects

- Objectively focus on maximizing shareholder value

- Derisk challenged projects

- Restore transparency and integrity to Company disclosures

- Appropriately align compensation

Successfully executing on these initiatives should close the valuation multiple discount at which Air Products trades and generate significant value for Air Products’ shareholders.

Over the past five years, Air Products’ current Board and CEO have grossly underperformed in nearly every critical aspect of their roles, resulting in the substantial underperformance of the business; a dysfunctional governance structure; the hollowing out of the Company’s ranks; and the encumbering of the business with challenging, high-risk, off-strategy projects. The Board’s years of “self-refreshment” have proven to simply extend and perpetuate this dysfunction.

And now, in his latest effort to avoid losing control, Air Products’ entrenched octogenarian CEO, Seifollah “Seifi” Ghasemi, seeks to convince shareholders that as the person responsible for the challenged projects, he can better remediate them than the world-class executive available to replace him. In fact, the conflicts created by his authorship have already caused his remediation efforts to destroy still more shareholder value.

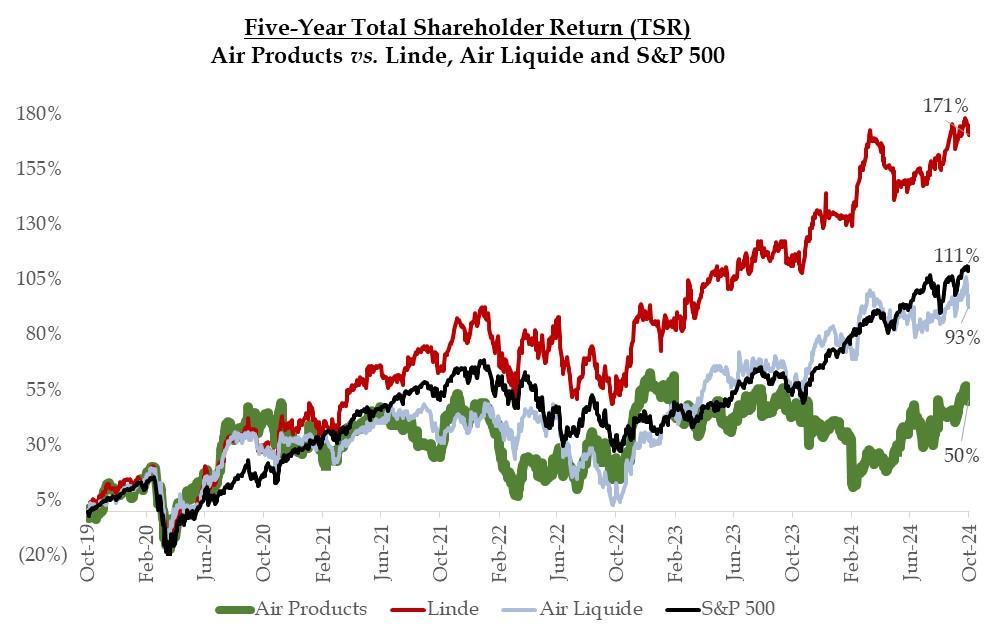

The five-year relative total shareholder return (“TSR”)1, ending October 4th, 2024, the day before announcing our efforts to press for change catalyzed a nearly 10% jump in the Company’s shares, tells a powerful story – Air Products has delivered roughly one-half of the TSR of competitor Air Liquide and the S&P 500, and less than one-third of the TSR of best-in-class competitor Linde Plc.

Shareholders should ask just one question: what Board composition will best improve the Company’s governance over the long-term, best guide the ongoing CEO succession process, and best address Air Products’ material underperformance? The answer is beyond doubt.

A reconstituted Board that replaces Air Products’ four most problematic directors with the four new, highly-qualified independent nominees described herein, will give the Company the best chance of improving its governance and culture, and a chance to select a new CEO that is best suited to create long-term value for shareholders and other stakeholders. Absent shareholder intervention, the Board will continue perpetuating its dysfunction, and the CEO succession process will be run by the same people who have been responsible for the Company’s current underperformance and constellation of problems.

The damage must be stopped. The time is now for shareholders to assert themselves, and to protect the Company and their investment in it.

We have a golden opportunity to do so. Though the incumbent Board has flatly rejected even considering his candidacy, we have identified an exceptional CEO candidate – Mr. Eduardo Menezes, a former executive from best-in-class competitor Linde Plc – who is ready, willing and able to be the new CEO of the Company, should he be chosen through a proper Board-led search process.

Backed by a shareholder-restructured Board, we are confident that Mr. Menezes can execute this plan.

Further, if he has the benefit of a reconstituted Board that includes Mr. Dennis Reilley, the storied former Chairman, President and Chief Executive Officer of Praxair (now part of Linde Plc), we expect the impact of Mr. Menezes’ leadership to be even more pronounced. To many, the result of empowering this “Dream Team”2 at Air Products is clear:

“Reilley and Menezes have proven themselves as excellent industrial gas executives. Reilley, who is now 71, has demonstrated managerial expertise at the CEO level and Menezes, who is 61, has shown high competence in large operational roles. If Seifi Ghasemi were to stand aside, it would be difficult to imagine a stronger pair of candidates to take his place.”

– JP Morgan, 10/18/2024

The incumbents seek to be entrusted with the sacred responsibility of allocating and investing Air Products’ future discretionary cash flow, which is the single most consequential driver of future intrinsic value. They are not worthy of your trust. Their track record in capital allocation starkly demonstrates that they are fundamentally unqualified for this role. When combined with their inability to be objective about managing through challenged projects they themselves authored, this fact makes them the last people one would want for that task.

By contrast, if chosen by a reconstituted Board, Mr. Menezes is well positioned to make the most of the Company’s challenged projects, prudently invest its cash flows to drive low-risk, high-return growth, and help Air Products achieve its fullest potential over the decade ahead.

Accordingly, we are asking for your vote to elect four superbly qualified nominees to the Company’s Board – Andrew Evans, Paul Hilal, Tracy McKibben, and Dennis Reilley. These executives are committed to helping enhance the Board’s governance and performance, maximize the value of the Company’s existing projects, and oversee a well-designed Board-led search process to replace the current CEO as soon as possible with one that will best serve the shareholders’ interests.

We are also asking for you to withhold your vote from the four Company nominees who we believe are individually most responsible for the failures and dysfunction of the last five years: Charles Cogut, Lisa A. Davis, Seifollah Ghasemi and Edward L. Monser.

We believe that a shareholder-led restructuring of the Board, followed by the prompt installation of the best CEO for this job, will create enormous value for the Company, its shareholders, and all of its stakeholders over both the near- and long-term.

Chapter One and Chapter Two

Ten years ago, while working at a predecessor firm, we played a leading role in helping Air Products resolve its prior issues and multiply its value. This included identifying and bringing Mr. Ghasemi to the Company to eliminate substantial excess costs and waste, eliminate the matrix organization, and divest non-core units. That restructuring plan – a period we call “Chapter One” – was completed in five years.

Chapter Two has been, and going forward will be, about reinvesting the Company’s cash flow to consistently deliver the greatest possible value-creating growth. It is far more challenging than Chapter One and requires different skills and strengths.

Without question, the greatest possible value-creating growth Air Products can achieve is through the disciplined pursuit of, and execution on, the extraordinary low-risk, high-return opportunities available solely to global industrial gas companies (“Core Gas Projects”). This includes any and all clean energy and energy transition projects that are structured in alignment with the Core industrial gas model.

Doing so requires dependable project underwriting and execution, and the ability to develop, empower, and retain talent. It requires reliably avoiding bad projects that destroy value. Just like the Company’s competitors do well.

By investing exclusively in opportunities3 whose risk and return characteristics are consistent with Core Gas Projects, and consistently avoiding less attractive projects, the Company can avoid diluting its returns on invested capital. At the same time, it can avoid reducing the market value of its low-risk Core business by adulterating it with excess risk.

“Investors own industrial gas companies because they are viewed as high-quality, lower volatility compounders…the multiple compression you’re seeing is the market expressing increasing concern about strategy /thesis-creep on a business that should be fairly steady and cash generative.”

– Barclays, 2/5/2024

It takes many years of industrial gas industry experience to develop and master the needed skills. And only an executive who has attained mastery and also has strong leadership skills, can build a team that reliably executes this extraordinary investment program at scale.

Regrettably, over these past five years, Mr. Ghasemi has proven that he lacks the requisite qualities, as evidenced by Air Products’ five-year performance relative to peers and the broader market.

As of October 4th, 2024, the day before our surfacing catalyzed a nearly 10% jump in the Company’s shares, Air Products’ five-year TSR underperformed its closest peers Linde Plc., Air Liquide, and the S&P 500 by 121%, 43%, and 61% respectively. 4

The proximate cause of this underperformance is Mr. Ghasemi’s inability to avoid bad projects, and his inability to reliably execute on them. His underwriting and execution missteps have been on a massive scale – many projects, many years, and billions of dollars.

The root cause of this underperformance is the Board’s broad-based dysfunction and performance failure, including its failure to timely identify Mr. Ghasemi’s unsuitability and poor performance, and to install a better-suited successor. The Board also failed in its duty to safeguard the strategy and the Company’s capital.

Air Products needs a far stronger Board, and it’s clear that their attempts at a refresh program are not working.

Poor Strategy, Misallocated Capital, Poor Execution

Properly structured and executed, Core Gas Projects can be of unusually low risk – insulated from inflation, commodity prices, economic cycles, counterparty credit risk, technology and engineering risk, budget overrun and project delay risk, regulatory and political risk, and other risks. Because industrial gas companies typically maintain capital discipline when bidding, these low-risk projects can also generate very attractive returns.

Because Air Products’ competitors have stuck exclusively to such projects, they deliver exceptional returns on capital, have created enormous value at an attractive rate, and deserve the premium valuation they command. This is the kind of performance Air Products’ shareholders deserve.

Yet the Board has allowed Mr. Ghasemi to spend or commit tens of billions of dollars to projects with unacceptably elevated risks far outside industry norms. These risks were evident and even called out publicly by third parties from inception. By comparison, the Company’s peers have immaterial exposure to high-risk projects.

“In practice, investors remain skeptical of APD’s backlog story, deterred by its complexity, lack of detailed financial information and a risk profile that can appear more typical of the Energy sector, arguably diluting the defensive properties of the traditional Industrial Gases business model.”

– Redburn, 11/17/2023

“… in the 3½ years since Air Products unveiled its clean energy strategy… investors have grown increasingly concerned about the cost, timing and offtake arrangements for these projects. In particular, investors are increasingly focused on the off-take of these projects (at what price and to whom).”

– Deutsche Bank, 11/8/2023

“APD’s willingness to commit substantial capital to drive growth, through complex megaprojects … has added risks and costs as well as stretching APD’s balance sheet… As stocks, the gas majors are prized above all else for their dependability.”

– Bernstein, 7/1/2024

The promised outsized returns of these high-risk projects remain “speculative but likely mediocre” or have proven to be below those earned from low-risk Core Gas Projects, and sometimes below the Company’s cost of capital.

Mr. Ghasemi’s poor underwriting and poor execution – including budget overruns, delays, permitting issues, and the like – have led to poor performance and several unexpected and disappointing updates to an extent and frequency without precedent in the gas industry:

“. . . setbacks in its mega-projects strategy saw APD’s share price fall >6% on six results days since 4Q20, (something not seen once at either LIN or AL) and with the gas majors prized above all else for their dependability, APD’s share remain below levels seen in early 2020, vs LIN up over 2x and AL up 50%+.”

– Bernstein, 10/7/2024

The Board’s misconceived compensation structures have contributed to this dysfunction.

The Board Has Countenanced Mr. Ghasemi’s Depleting the Organization

Beyond his poor capital allocation, Mr. Ghasemi’s management style, his repeated commitment to never leave his role so long as he is alive, and other factors have led to an exodus of talent and enhanced the difficulty of recruiting fresh talent. The directors with whom we met described a human capital pyramid depleted to the point where there remains “only a General, and privates acting at his direction, and no layers in between”. They underscored the critical need of hiring a new CEO who could successfully rebuild the Company’s depleted human capital.

Omissions, Obfuscations, Misdirections . . . and Worse

As Mr. Ghasemi’s projects have struggled, and as the shareholders’ calls for leadership change have mounted, we have seen a shift in his disclosures and public statements. Transparency has declined, and we have seen him descend into obfuscation and misdirection. These relate to Air Products’ challenged projects, its supposed superior performance, and other topics. We will address some of these at a later date.

Beyond the concerns these raise about the challenged projects, they cast doubt on future announcements and proclamations the Company may unveil in the coming weeks.

In future communications, we will also address the untrue statements Mr. Ghasemi and the Board continue to make to the shareholders directly, in their filings, and through surrogates.

The Current Board Has Failed to Implement a Viable Succession Plan

Mr. Ghasemi is 80 years old and is the oldest CEO in the S&P 500 after Warren Buffett. Yet after a decade, including five years of substantial underperformance, there remains no internal succession pipeline.

This deficit was highlighted on July 22, 2024, when the Company’s former COO Dr. Samir Serhan unexpectedly resigned from his position. With no COO successor in place, the Company created a “Management Board” of existing Air Products leaders reporting directly to Mr. Ghasemi.5 As a result, Air Products today finds itself with an octogenarian CEO leading the Board, running a 23,000-person global company, executing on a $20 billion backlog and managing 11 direct reports, with no COO to support him.

We believe the Company and its shareholders deserve better stewardship.

Core to the issue is Mr. Ghasemi’s commitment to prevent his removal. Let us hear from Mr. Ghasemi directly:

- “As long as I’m vertical, I’m going to be Chairman of Air Products, and I mean that” 6

- “I am not going anywhere” 7

With this mentality, to what lengths will Mr. Ghasemi not go to hold onto his job? Is he looking out for the shareholders, or himself? What example do these words set for the team and the culture? How can he be trusted a day longer in this role? How can a board who countenanced this be permitted to continue perpetuating itself?

In future communications, we will discuss further the Board’s performance on succession and management development, as well as the deficiencies in executive compensation that have exacerbated these problems.

The Board “Refreshes Itself” But the Pathology Persists

Since Mr. Ghasemi’s appointment as CEO, the Board has refreshed a majority of its own seats, yet it nevertheless continues to underperform on a broad range of its core duties (which we will address in the future):

- Managing its own composition, structure, internal processes, and culture

- CEO selection, succession planning

- Executive/management development

- Executive compensation

- Overseeing strategy

- Overseeing capital allocation and capital return policy

- Defending the balance sheet

- Shareholder engagement

To facilitate the process of a collaborative Board restructuring, we offered to the Board a selection of nine superb director candidates that the Board might choose from, and offered to share more names, or source more. They sought no information, and held no interviews.

The Board’s preemptory finding that all nine of our proposed candidates were “substandard”10 and “not as strong” 11 as theirs reveals their views on Board refreshment. It’s hard to imagine that a Board that told us that at least four of its independent directors intended to soon roll off would not be interested in learning more about those nine.

Statements such as these raise further questions about the Board’s judgment, or worse, calls into question their ability to act as fiduciaries on the conflict-laden question as to whether their own continued service is in the best interests of the shareholders.

That these statements were made by the directors (our agents) to us as shareholders (their principals), on the important matter of determining their eligibility for continued service, raises questions about their fitness to serve as a fiduciary for us, or for anyone else.

The Board’s flat exclusion of Mr. Menezes from the succession process also makes it difficult to imagine that Mr. Ghasemi and the incumbent Board are seeking the best CEO for the Company. Mr. Ghasemi’s shortcomings make him the wrong person to choose or develop a successor. And conflicts arising from his authorship of the troubled projects compromise his ability, and the ability of the Board as constituted, to pursue succession in the shareholders’ best interest.

“The Dream Team”

We now have an exceptional opportunity to realize the performance improvements Air Products’ shareholders deserve. We can do so through shareholder-led Board change, with a reconstituted Board that will seek to help guide a well-designed Board-led search process to replace the current CEO as soon as possible.

We have identified a seasoned industrial gas industry executive, Eduardo Menezes, who we believe is an ideal candidate that should be considered for the CEO role.

Mr. Menezes is a distinguished leader in the industrial gases sector with more than three decades of experience at the companies recognized as the best run industrial gas companies in the world. He most recently served as the EVP of EMEA for Linde Plc (formerly Praxair and Union Carbide), the best performing company in the industry, where he was responsible for more than $8 billion in sales and 18,000 employees – a business line nearly the size of Air Products today. In this role, he restructured the business, driving a 550-basis-point improvement in the operating margin of the segment in just three years.

Reflecting his value, Mr. Menezes spent his last 11 years at Linde and its predecessor, Praxair, as a direct report to the CEO. He has at some point in his career been responsible for industrial gas operations in every region of the world. Prior to Linde, Mr. Menezes served in key operational and executive roles at Praxair and was a key member of the team proposing, negotiating, and obtaining regulatory approval for Praxair’s merger with Linde AG.

Upon the retirement of Linde’s CEO in 2021, Mr. Menezes was one of just two finalists to succeed him in the CEO role. When the able alternative was selected, Mr. Menezes retired.

Being selected as the runner up to be the CEO of the best industrial gas company in the world, a company that has handily outperformed Air Products for decades, strikes us as an achievement that might merit an interview in the CEO selection process.

The pairing of Mr. Menezes as a possible CEO with our Board nominee Mr. Reilley as a possible Chairman or Executive Chairman is widely regarded as a superlative solution to the Company’s succession problem, and in fact has been widely hailed as the “Dream Team.”12 The enthusiasm by those familiar with them and their records and accomplishments is extraordinary:

“Mantle Ridge has added two former Linde Executives (Dennis Reilly and Eduardo Menezes) to reshape APD’s sustainability growth strategy. This “Dream Team” could make a difference in the battle for control given strong track records and experience.”

– Wells Fargo, 10/15/2024

“There is no better-qualified executive in the industrial gas space than Dennis Reilley, who honed the strategy at Praxair to focus on the cost of delivering industrial gases, from plant design to build and operation. Years of continuous improvement gave Praxair, and now Linde, a competitive lead that is hard to match. Eduardo Menezes sat in key operational and regional leadership roles at Praxair and was then given the most challenging region at the combined Praxair/Linde to manage – Europe, Middle East, and Africa. The success of Linde since the merger has been due to the very effective execution of the business combination and Mr. Menezes was central to that success.”

– CMACC, 10/15/2024

“This looks very much like a ‘dream team’. Dennis Reilley was the original architect of Praxair’s strategy when it was spun out of Union Carbide in 1993, and is responsible for its unique culture, focus on operational excellence and disciplined capital allocation. Eduardo Menezes successfully ran the Praxair North and South America businesses, and latterly Linde’s EMEA segment before retiring in 2021.

– Redburn, 10/25/2024

“We would expect both Mr. Reilley and Mr. Menezes to be seen as strong candidates by investors: Linde (formerly Praxair) is currently considered by many investors as the standard bearer of operational excellence in the industrial gas space, and short of Mantle Ridge convincing Linde’s current C-suite to join them, we think these two are among the best alternatives.”

– Barclays, 10/15/2024

“Mr. Reilley was one of the architects of Praxair’s highly successful industrial gas strategy, a strategy which is still in existence today…Mantle Ridge is eyeing

Mr. Reilley to become Air Products executive chairman and Eduardo Menezes, former Linde and Praxair executive, as Air Products CEO. Mr. Menezes is a well-regarded industrial gas executive. As such, the management team proposed for Mantle Ridge to lead Air Products is, our view, strong as well.”

– Deutsche Bank, 11/24/2024

“Reilley and Menezes have proven themselves as excellent industrial gas executives. Reilley, who is now 71, has demonstrated managerial expertise at the CEO level and Menezes, who is 61, has shown high competence in large operational roles. If Seifi Ghasemi were to stand aside, it would be difficult to imagine a stronger pair of candidates to take his place.”

– JP Morgan, 10/18/2024

It is hard to imagine better news for a dutiful board genuinely focused on maximizing shareholder value than the notion that two storied executives with long records of superlative performance at the best run player in the industry are prepared to drive to the headquarters and start tomorrow. On top of their credentials and superlative performance, they understand – and in fact contributed to the authorship of – the best practices that have made Praxair and its successor Linde so successful.

The Board’s refusal to invite Mr. Menezes into the recruitment process or to interview Mr. Reilley or any of our other three nominees before recommending that shareholders vote against them speaks volumes about their approach to succession and board refreshment, and what their true intentions are. Are they seeking the best CEO for shareholders? Or the best for them?

We must decisively turn the page.

We are convinced that the Company’s performance, and therefore value, will be enhanced materially if the shareholders effect the changes they deserve.

The Nominees Who Can Refresh Air Products

We believe Air Products’ core business has a strong foundation, and that the Company’s problems are self-inflicted and can be remedied quickly with the right changes to the Board and with the right CEO. To help drive those changes, we are nominating four superbly qualified individuals for election at the upcoming Annual Meeting.

Each of these nominees is entirely independent of the others (only Mr. Hilal is affiliated with Mantle Ridge). They collectively bringdecades of unparalleled industry expertise, relevant skillsets, and the public company board experience necessary to restore good governance, prudent capital allocation, and long-term leadership at Air Products for the benefit of all stakeholders.

Details of their compelling backgrounds can be found in our proxy materials. Listed alphabetically, they are:

- Andrew Evans – Former CEO/COO of AGL Resources (NYSE: AGL) and CFO of Southern Company (NYSE: SO)

- Paul Hilal – Founder and CEO of Mantle Ridge LP

- Tracy McKibben – Founder and CEO of MAC Energy Group

- Dennis Reilley – Former Chairman, President and Chief Executive Officer of Praxair, Inc. (now part of Linde, Plc) (NASDAQ: LIN)

We ask you to vote FOR our four nominees – and to WITHHOLD your vote from Company nominees Charles Cogut, Lisa A. Davis, Seifollah Ghasemi and Edward L. Monser. Together, we can restore Air Products to its former greatness.

On Behalf of the Mantle Ridge Team,

Paul Hilal, CEO

Mantle Ridge LP

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

The information herein contains “forward-looking statements.” Specific forward-looking statements can be identified by the fact that they do not relate strictly to historical or current facts and include, without limitation, words such as “may,” “will,” “expects,” “believes,” “anticipates,” “plans,” “estimates,” “projects,” “potential,” “targets,” “forecasts,” “seeks,” “could,” “should” or the negative of such terms or other variations on such terms or comparable terminology. Similarly, statements that describe our objectives, plans or goals are forward-looking. Forward-looking statements are subject to various risks and uncertainties and assumptions. There can be no assurance that any idea or assumption herein is, or will be proven, correct. If one or more of the risks or uncertainties materialize, or if any of the underlying assumptions of Mantle Ridge LP and its affiliates (collectively, “Mantle Ridge”) or any of the other participants in the proxy solicitation described herein prove to be incorrect, the actual results may vary materially from outcomes indicated by these statements. Accordingly, forward-looking statements should not be regarded as a representation by Mantle Ridge that the future plans, estimates or expectations contemplated will ever be achieved.

Certain statements and information included herein may have been sourced from third parties. Mantle Ridge does not make any representations regarding the accuracy, completeness or timeliness of such third party statements or information. Except as may be expressly set forth herein, permission to cite such statements or information has neither been sought nor obtained from such third parties, nor has Mantle Ridge paid for any such statements or information. Any such statements or information should not be viewed as an indication of support from such third parties for the views expressed herein.

Mantle Ridge disclaims any obligation to update the information herein or to disclose the results of any revisions that may be made to any projected results or forward-looking statements herein to reflect events or circumstances after the date of such information, projected results or statements or to reflect the occurrence of anticipated or unanticipated events.

CERTAIN INFORMATION CONCERNING THE PARTICIPANTS

Mantle Ridge LP and the other Participants (as defined below) have filed a definitive proxy statement (the “Definitive Proxy Statement”) and accompanying BLUE universal proxy card or voting instruction form with the SEC to be used to solicit proxies for, among other matters, the election of its slate of director nominees at the 2025 annual meeting of stockholders of the Company (the “2025 Annual Meeting”). Shortly after filing the Definitive Proxy Statement with the SEC, Mantle Ridge LP furnished the Definitive Proxy Statement and accompanying BLUE universal proxy card or voting instruction form to some or all of the stockholders entitled to vote at the 2025 Annual Meeting.

The participants in the proxy solicitation are Mantle Ridge LP, Eagle Fund A1 Ltd, Eagle Advisor LLC, Paul Hilal (all of the foregoing persons, collectively, the “Mantle Ridge Parties”), Andrew Evans, Tracy McKibben and Dennis Reilley (such individuals, collectively with the Mantle Ridge Parties, the “Participants”).

IMPORTANT INFORMATION AND WHERE TO FIND IT

MANTLE RIDGE LP STRONGLY ADVISES ALL STOCKHOLDERS OF THE COMPANY TO READ ITS DEFINITIVE PROXY STATEMENT, ANY AMENDMENTS OR SUPPLEMENTS TO SUCH PROXY STATEMENT AND OTHER PROXY MATERIALS FILED BY MANTLE RIDGE LP WITH THE SEC AS THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. SUCH PROXY MATERIALS WILL BE AVAILABLE AT NO CHARGE ON THE SEC’S WEBSITE AT WWW.SEC.GOV. THE DEFINITIVE PROXY STATEMENT AND OTHER RELEVANT DOCUMENTS ARE ALSO AVAILABLE ON THE SEC’S WEBSITE, FREE OF CHARGE, OR BY DIRECTING A REQUEST TO THE PARTICIPANTS’ PROXY SOLICITOR, D.F. KING & CO., INC., 48 WALL STREET, 22ND FLOOR, NEW YORK, NEW YORK 10005. STOCKHOLDERS CAN CALL TOLL-FREE: (888) 628-8208.

Information about the Participants and a description of their direct or indirect interests by security holdings or otherwise can be found in the Definitive Proxy Statement.

Investor Contact

D.F. King & Co., Inc.

Edward McCarthy

Tel: (212) 493-6952

Media Contacts

Jonathan Gasthalter / Nathaniel Garnick

Gasthalter & Co.

Tel: (212) 257-4170

1 Source: Bloomberg, as of 10/4/2024, the trading day before Mantle Ridge’s surfacing. Returns in USD and assumes dividends are reinvested.

2 Source: October 15, 2024, Wells Fargo

3 This includes direct investment solely in such projects, or indirect investment into existing projects through share repurchases.

4 Source: Bloomberg, as of 10/4/2024, the trading day before Mantle Ridge’s surfacing. Returns in USD and assumes dividends are reinvested.

5 Source: July 22, 2024 Company Press Release, “Air Products’ Chairman, President and CEO Seifi Ghasemi Announces Formation of Senior Management Board”

6 Source: June 9, 2020, APD CEO comments, Deutsche Bank conference

7 Source: May 27, 2020, APD CEO comments, Bernstein conference

8 Source: December 18, 2023 transcribed expert network call with former APD SVP: “But as he’s made it very clear that he’s not going to retire from Air Products. He’s going to leave in a box those are his words not mine.”

9 Source: June 27, 2022 transcribed expert network call with former APD Director of Business Development: “But at the end of the day I mean, he told us that he wants to work until he is, like, 100 years old.”

10 Source: APD letter to shareholders, 12/4/2024: “Mantle Ridge is seeking to replace all of the directors on our Board with its own substandard nominees”

11 Source: APD definitive proxy filings, 12/3/2024: “[T]he background and experiences of the Mantle Ridge Nominees were either not as strong as the Company Nominees…”

12 Source: October 15, 2024, Wells Fargo